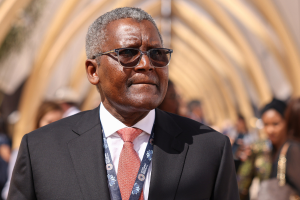

Abuja, Nigeria – Nigeria’s central bank has opted to keep its main interest rate unchanged at 27.5%, marking the second consecutive meeting the Monetary Policy Committee (MPC) has held the rate steady this year. The decision was announced by the Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, following the MPC’s 300th meeting in Abuja on Tuesday.

The hold comes after a series of six consecutive rate hikes throughout 2024, as the bank grappled with persistent inflationary pressures. Governor Cardoso stated that the unanimous decision to retain the Monetary Policy Rate (MPR) would allow members to “better understand near-term developments in the economy.”

Alongside the MPR, the CBN also maintained the asymmetric corridor around the MPR at +500/-100 basis points, and kept the Cash Reserve Ratio for Deposit Money Banks at 50% and for Merchant Banks at 16%. The Liquidity Ratio remains unchanged at 30%.

Cautious Optimism on Inflation

The MPC’s decision was influenced by recent improvements in key macroeconomic indicators. The National Bureau of Statistics reported a drop in Nigeria’s headline inflation to 23.71% in April 2025, down from 24.23% in March. Month-on-month inflation also saw a significant decline, from 3.9% to 1.86%.

Food inflation eased to 21.26% from 21.79%, while core inflation, which excludes volatile agricultural produce, fell to 23.39% in April from 24.43% in March.

Governor Cardoso acknowledged these developments with “cautious optimism,” noting that they are expected to support overall price moderation in the near to medium term. He also commended the government’s efforts to boost food supply and address insecurity in farming communities.

Persistent Challenges and Economic Growth

Despite these gains, the CBN remains concerned about lingering inflationary pressures, which are primarily driven by high electricity costs, sustained demand for foreign exchange, and underlying structural issues within the economy.

The committee welcomed the Nigerian federal government’s reforms aimed at increasing local production and reducing the demand for foreign exchange, believing these measures will help temper inflationary pressures. The MPC also reviewed developments in the foreign exchange market, urging the central bank to continue implementing reforms to enhance investor confidence.

Governor Cardoso highlighted a positive increase in Nigeria’s gross external reserves, which grew by 2.85% to $38.90 billion as of May 16, 2025, up from $37.82 billion at the end of March. This represents approximately 7.6 months of import cover. The committee was also encouraged by the narrowing gap between the official and parallel foreign exchange market rates and urged fiscal authorities to intensify efforts to boost FX earnings, particularly from oil, gas, and non-oil exports.

Nigeria’s real GDP saw an improvement, growing by 3.84% in the fourth quarter of 2024, up from 3.46% in the previous quarter. This growth was driven by both oil and non-oil sectors, with services playing a notable role. However, the MPC expressed concern about recent declines in global crude oil prices, which could pose challenges for government revenues and budget implementation.

Looking ahead, the next MPC meeting is scheduled for July 21 and 22, 2025.

Add Comment