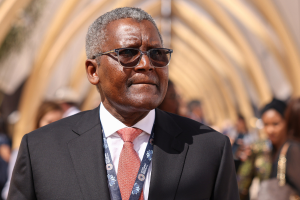

Nigeria’s Minister of Finance, Wale Edun, has announced plans to impose a 15% Value Added Tax (VAT) on luxury goods, while exempting essential items for the poor and vulnerable. Edun made this statement at the IMF/World Bank Annual Meetings in Washington DC.

Key Points:

- 15% VAT on Luxury Goods: Targeted tax to increase revenue

- Protection for the Poor: Zero or reduced VAT on essential goods

- Total Subsidy Removal: Effective September 2024

- Oil Sector Growth: Increased foreign exchange expected due to improved security and new investments

Mr. Edun clarified that the bill, currently before the National Assembly, aims to raise VAT for the wealthy while protecting the poorest and most vulnerable. The list of zero-VAT essential goods will be made public soon.

Additionally, Mr. Edun expressed optimism about the oil sector’s potential to boost foreign exchange, thanks to enhanced security and investments from Total and ExxonMobil. The complete removal of fuel subsidies, effective last month, is expected to yield significant savings for the economy.

This development aligns with President Bola Tinubu’s commitment to implementing necessary reforms while safeguarding the most vulnerable Nigerians.

Add Comment