The Central Bank of Nigeria’s Monetary Policy Committee has unanimously voted to increase the benchmark interest rate, also known as the Monetary Policy Rate (MPR), to 27.25%.

This decision aims to further tighten monetary policy, marking an 8.5% increase in interest rates since the current leadership took office a year ago.

The new rate represents a 50 basis points increase from the 26.75% announced in July 2024. The MPR serves as the baseline interest rate in Nigeria’s economy, influencing all other interest rates.

Key Decisions:

- Monetary Policy Rate (MPR): Raised to 27.25%

- Asymmetric Corridor: Retained at +500 to -100 basis points around the MPR

- Cash Reserve Ratio (CRR):

- Deposit Money Banks: Raised by 500 basis points to 50%

- Merchant Banks: Raised by 200 basis points to 16%

- Liquidity Ratio: Retained at 30%

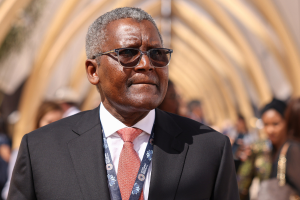

Governor Olayemi Cardoso announced these decisions after the committee’s fifth meeting this year, held at the CBN headquarters in Abuja. Despite expectations of a rate hold or decrease due to declining headline inflation, the committee opted to tighten monetary policy.

Add Comment